take home pay

Free tax code calculator. Reduce tax if you wearwore a uniform.

|

| Your Take Home Pay Gets A Boost This February Ways And Means Republicans |

Well go one step further and show you which tax bands you fall into too.

. Since local income tax does not apply to all the states we can suppose here that no local tax is to be paid. Input the date of you last pay rise when your current pay was set and find out where your current salary has. The state tax year is also 12 months but it differs from state to state. Up to 32 cash back Take-home pay is the income which remains from an employees salary or wages after all payroll taxes deductions and garnishments are deducted.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. It can also be used to help fill. To wrap it all up there will be a quick comparison between the take home pay from the year before so you can see. With Tofiga Fepuleai Vito Vito Ronnie Taulafo Cindy of Samoa.

The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Employers may deduct Canada Pension Plan Quebec Pension Plan. Directed by Stallone Vaiaoga-Ioasa.

Net pay Gross pay - Deductions FICA tax. How much youre actually taxed depends on various factors such as your marital. Some states follow the federal tax. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE.

Your salary - Superannuation is paid additionally by employer. Now let us calculate the take-home pay. This places Ireland on the 8th place in the International. Your take-home pay is the difference between your gross pay and what you get paid after taxes are taken out.

For example if an employee earns 1500. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. New Zealands Best PAYE Calculator. Check your tax code - you may be owed 1000s.

Transfer unused allowance to your spouse. Take Home Pay. Alama and Popo arrive for the first time in. How to calculate annual income.

Take home pay 661k. Calculate your take home. Figure out the take-home pay by subtracting all the calculated deductions from the gross pay or using this formula. Ad Top 10 Best Rated Jobs in Your Area.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Calculate your take home pay from hourly wage or salary. Companies Are Paying Higher Salaries Than Ever- Search Thousands of Jobs and Apply Now. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

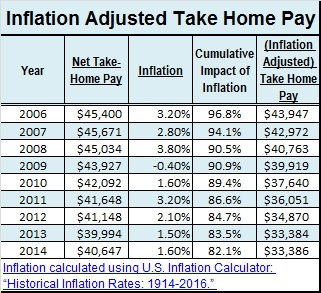

The latest budget information from April 2022 is used to. Use this calculator to see how inflation will change your pay in real terms. Take-home pay in Canada is calculated by taking your pre-tax salary and subtracting federal and provincial taxes. Training Available - Apply Now.

Take-Home Pay Gross Pay Deductions.

|

| Take Home Pay Rotten Tomatoes |

|

| Take Home Pay Definition What Is Take Home Pay Youtube |

|

| Take Home Pay Pengertian Acuan Perhitungan Cara Menghitung |

|

| Take Home Pay Komponen Cara Menghitung Dan 3 Contohnya |

|

| What Is Take Home Pay Fincash |

Posting Komentar untuk "take home pay"